Photo by Morgana Wingard/Getty Images Photo by Morgana Wingard/Getty Images

'Time's Up, White People': South African Politician Gloats As Deadline Set For Land Grab Amendment

By HANK BERRIEN December 10, 2018 Last week, as the National Assembly in South Africa agreed to set a date for whites to have their land taken away, proponents of the land grab exulted, with one politician gloating, “Your time is up, white people.” A motion from African National Congress (ANC) chief whip Jackson Mthembu to require the legislature to ensure a constitutional amendment to allow land expropriation without compensation was adopted, with 183 yea votes and 77 nay votes. The amendment would change section 25 of the constitution, which statesthat a “just and equitable” payment which reflects “an equitable balance between the public interest and the interests of those affected” must be offered for land. The motion forces a deadline of March 31, 2019, to complete the work of writing the legal change and presenting it. Economic Freedom Fighters MP Hlengiwe Mkhaliphi argued land grabs should occur, declaring: “Your time is up, white people.” Themba Godi, from the African People's Convention, echoed, "Land must be nationalized and socialized for the benefit of the people, especially the working class and women ... those who oppose want the perpetuation of wrongs of past." Freedom Front Plus’ Anton Albert countered by addressing the ANC benches, saying, "When the blood flows it will be on your hands.” IFP MP Mkhuleko Hlengwa added, “To achieve real and effective land reform is (possible) under the existing constitution, not your (ANC) populist agenda. You should be ashamed of yourself.” In February 2018, the National Assembly ruled that white South African farmers would be removed from their land. The vote, prompted by a motion brought by radical Marxist opposition leader Julius Malema, was not even close; 241 legislators voted for it with only 83 voting against it. Malema told his supporters in 2016 he was “not calling for the slaughter of white people — at least for now.” News24 reported Malema saying before the vote was taken, "The time for reconciliation is over. Now is the time for justice." Gugile Nkwinti, minister of water affairs, echoed, "The ANC (African National Congress) unequivocally supports the principle of land expropriation without compensation. There is no doubt about it, land shall be expropriated without compensation." In August, South African President Cyril Ramaphosa announced that the African National Congress would move forward in amending the constitution to permit the seizure of white farmers' lands without compensation. Later that month, it was reported that a record number of farms were for sale because white farmers tried to offload land and leave the country before the government confiscated their farms. As The Daily Wire reported in August, “South Africans — both black and white — aren't thrilled with the idea since a major re-appropropration and re-division of land would severely harm South Africa's farming industry, destroying jobs and opportunities for both black and white workers. Others, with knowledge of history — particularly what happened after the government grabbed land from white farmers in neighboring Zimbabwe — say they're terrified the government has no real plan for its seizure and could send the country tumbling into economic ruin.”

Three critical lessons from Europe’s recent mini-meltdown

Simon Black June 1, 2018 Manila, Philippines Trying to trace the origins of the latest political crisis in Italy is like… well… trying to trace the origins of the decline of the Roman Empire. There simply is no good starting point. You can’t talk about the decline of Rome without a lengthy discussion of how destructive Diocletian’s Edict on Wages and Prices was in the early 4th century. But you’d have to go further back than that and discuss all the lunatic emperors preceding him, all the way back to Caligula. Did you know? You can receive all our actionable articles straight to your email inbox... Click here to signup for our Notes from the Field newsletter. But you can’t talk about Caligula without bringing up the effects of the civil war between Octavian and Marc Antony… which was a direct result of the previous civil war between Julius Caesar and Pompeius Magnus. Before long you’ve gone back in time more than 500 years trying to figure out why the Roman Empire collapsed. Modern Italy isn’t so different. After all, this is a country so unstable that it’s had 64 governments in the seven decades since the end of World War II, averaging a new government every 14 months. That has to be some kind of world record. And to accurately diagnose how Italy ended up in such dire financial and political turmoil, you’d have to go back a -very- long way. But for the sake of brevity, we’ll just go back to March. Italy held elections, and the “5-Star Movement” political party won the most seats… but not a clear majority. This required them to establish a coalition with other political parties, which took weeks of haggling and negotiating. But finally the 5-Star Movement was able to hammer out a deal and present a formal plan to Italy’s head of state, President Sergio Mattarella. The President of Italy is almost purely a ceremonial role, like the Queen of England. But he does have the authority to reject key government appointments, including Prime Minister and Finance Minister. And that’s exactly what he did– specifically opposing the nominee for Finance Minister, an economist named Paolo Savona. Savona is a huge critic of the euro, and President Mattarella thought him too dangerous for the post. Again, while the origins are more complicated than that, this is the basic plotline behind the most recent crisis. Late Thursday night the Italian government announced a compromise, supposedly bringing an end to the uncertainty. But to me, none of that matters. What I find -really- important is what an enormous impact this soap opera had across the world. And I think there are three critical lessons to take away: 1) On the day that the finance minster was rejected, financial markets worldwide tanked. Italy’s stock market plunged 5%, which is considered a major drop. But curiously, the stock market in the US fell as well, with the Dow Jones Industrial Average shedding 400 points. Even markets in China and Japan had significant drops as a result of the Italy turmoil. Now, it’s easy to see why Italy’s markets fell. And even the rest of Europe. But the entire world? Granted, a lot of people made a really big deal out of this event, concluding that it signals the end of the euro.. or Europe itself… or some other such drama. Sure, maybe. But it’s almost impossible to foretell a trend as significant as ‘the end of the euro’ based on a single event. At face value, the rejection of a cabinet minister in Italy should have almost -zero- relevance on economies as large and diversified as the US, China, and Japan. To me, this is another sign that we’re near the peak of the bubble… and possibly already past it. Markets are so stretched, and investors are on such pins and needles, that even a minor, insignificant event induces panic. And it makes me wonder: if financial markets are so tightly wound that something so irrelevant can cause such an enormous impact, how big will the plunge be when something serious happens? 2) It wasn’t just stocks either. Bond markets were also keenly impacted. Bear in mind that stocks are volatile by nature; prices move much more wildly than other asset classes. But bonds, on the other hand, are supposed to be safe, stable, boring assets. Especially government bonds in highly developed nations. In Italy the carnage was obviously the worst. Investors dumped the 2-year Italian government bond, and yields (which move opposite to prices) surged from 0.9% to 2.4% in a matter of hours. Simply put, that’s not supposed to happen. And it hadn’t happened in at least three decades. Again, though, even in the United States, yields on the US 10-year note dropped 16 basis points overnight, from 2.93% to 2.77% (which means US bond prices increased). That’s considered MAJOR volatility for US government bonds. To put it in context, the only day over the past few YEARS that saw 10-year yields move more than that was the day after Donald Trump won the US Presidential Election in 2016. So it was a pretty big deal. Again, this leads me to wonder: if safe, stable assets like government bonds can react so violently from such an insignificant event, how volatile will riskier assets be when there’s an actual crisis? Just imagine what’s going to happen to all the garbage assets out there (like unprofitable, heavily indebted businesses) when a real downturn kicks in. 3) Perhaps most importantly, nobody saw this coming. Even just six months ago, it’s doubtful anyone would have predicted that the rejection of Italy’s finance minister would cause a global financial panic. And yet it happened. This is one of the most critical lessons of all: whatever causes the next major downturn can be something completely obscure and unpredictable. And no one realizes it until it’s too late. __________________________ Central Banks Are Going to Have to “Pull the Plug” on Stocks

It’s no secret that Central Banks have been funneling liquidity both directly and indirectly into stocks. However, what most investors don’t realize is that this liquidity pump is about to end. Why? Because the endless streams of liquidity (Central Banks continue to run QE programs of $100+ billion per month despite the global economy stabilizing) have unleashed inflation. Forget the “official” date. That stuff is all propaganda. Take a look at what is happening in the bond markets which trade based on inflation in the real world. When inflation rises, bond yields rise. And right now, sovereign bond yields are rising around the world. The yield on the US 10-Year Treasury has broken its 20-year downtrend. The US is not alone… the yield on 10-Year German Bunds has also broken its downtrend. Even Japan’s sovereign bonds are coming into the “inflationary” crosshairs with yields on the 10-Year Japanese Government Bond just beginning to break about their long-term downtrend. Because if bond rates continue to rise, many countries will quickly find themselves insolvent. Globally the world has added over $60 trillion in debt since 2007… and all of this was based on interested rates that were close to or even below ZERO. Central Bank cannot and will not risk blowing up this debt bomb. So they are going to be forced to “pull the plug” on liquidity and “let stocks go.” Put simply, if the choice is: 1) Let stocks drop and deal with complaints from Wall Street… Or… 2) Let the bond bubble blow up, destabilizing the entire financial system and rendering most governments insolvent… Central Banks are going to opt for #1 Every. Single. Time. On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts. It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here: https://phoenixcapitalmarketing.com/TEB.html Best Regards Graham Summers Chief Market Strategist Phoenix Capital Research __________________________

Thank You Kent Lamberson |

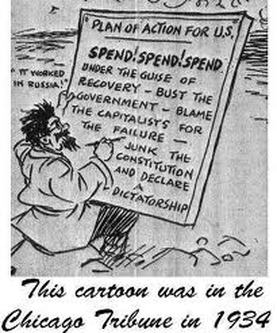

Centrally Planned Economy

By INVESTOPEDIA STAFF Reviewed By GORDON SCOTT Updated Jan 29, 2020 What is a Centrally Planned Economy? A centrally planned economy, also known as a command economy, is an economic system in which a central authority, such as a government, makes economic decisions regarding the manufacturing and the distribution of products. Centrally planned economies are different from market economies, in which such decisions are traditionally made by businesses and consumers. The production of goods and services in command economies is often done by state-owned enterprises, which are government owned companies. In centrally planned economies, which are sometimes referred to as "command economies", prices are controlled by bureaucrats. KEY TAKEAWAYS

Centrally Planned Economy Understanding Centrally Planned Economies Most developed nations have mixed economies that combine aspects of central planning with the free marketsystems promoted by classical and neoclassical economists. The majority of these systems skew heavily toward free markets, where governments intervene only to implement certain trade protections and coordinate certain public services. Theory of Central Planning Advocates of centrally planned economies believe central authorities can better meet social and national objectives by more efficiently addressing egalitarianism, environmentalism, anti-corruption, anti-consumerism and other issues. These proponents think the state can set prices for goods, determine how many items are produced, and make labor and resource decisions, without necessarily waiting for private sector investment capital. Central economic planning naysayers believe central entities lack the necessary bandwidth to collect and analyze the financial data required to make major economic determinations. Furthermore, they argue that central economic planning is consistent with socialistand communist systems, which traditionally lead to inefficiencies and lost aggregate utility. Free market economies run on the assumption that people seek to maximize personal financial utility and that businesses strive to generate the maximum possible profits. In other words: all economic participants act in their own best interests, given the consumption, investment, and production options they face before them. The inherent impulse to succeed consequently assures that price and quantity equilibrium are met and that utility is maximized. Problems With Centrally Planned Economies The centrally planned economic model has its fair share of criticism. For example, some believe governments are too ill-equipped to efficiently respond to surpluses or shortages. Others believe that government corruption far exceeds corruption in free market or mixed economies. Finally, there is a strong sense centrally planned economies are linked to political repression, because consumers ruled with an iron fist aren't truly free to make their own choices. Examples of Centrally Planned Economies Communist and socialist systems are the most noteworthy examples in which governments control facets of economic production. Central planning is often associated with Marxist-Leninist theory and with the former Soviet Union, China, Vietnam, and Cuba. While the economic performance of these states have been mixed, they've generally trailed capitalist countries, in terms of growth. [Important: While most centrally planned economies have historically been administered in authoritarian states, participation in such an economic paradigm theoretically can be elective. It’s official: the Federal Reserve is insolvent

Simon Black December 14, 2018 Sovereign Valley Farm, Chile In the year 1157, the Republic of Venice was in the midst of war and in desperate need of funds. It wasn’t the first time in history that a government needed to borrow money to fight a war. But the Venetians came up with an innovative idea: Every citizen who loaned money to the government was to receive an official paper certificate guaranteeing that the state would make interest payments. Those certificates could then be transferred to other people… and the government would make payments to whoever held the certificate at the time. Did you know? You can receive all our actionable articles straight to your email inbox... Click here to signup for our Notes from the Field newsletter. In this way, the loan that an investor made to the government essentially became an asset– one that he could sell to another investor in the future. This was the first real government bond. And the idea ultimately created a robust market of investors who would buy and sell these securities. When a government’s fortunes changed and its ability to make interest payments was in doubt, the price of the bond fell. When confidence was high, bond prices rose. It’s not much different today. Governments still borrow money by issuing bonds, and those bonds trade in a robust marketplace where countless investors buy and sell on a daily basis. Just like the price of Apple shares, the prices of government bonds rise and fall all the time. One of the most important factors affecting bond prices is interest rates: when interest rates rise, bond prices fall. And when rates fall, bond prices rise. And this law of bond prices and interest rates moving opposite to one another is as inviolable as the Laws of Gravity. Back in the 12th century when Venice started issuing the first government bonds, interest rates were shockingly high by modern standards, fluctuating between 12% and 20%. In France and England rates would sometimes rise beyond even 80% during the Middle Ages. Needless to say, it didn’t take long for banks to get in on the action; they realized very quickly that by controlling government debt, they effectively controlled the government. The dominance of the banks over the government cannot be overstated. Miriam Beard’s book History of the Businessman, for example, describes medieval politicians in the Italian city-state of Genoa as having to pledge loyalty to the banks before they were allowed to take office. Thus began the deep, long-standing relationship between banks and the government: Banks buy government debt– helping to finance spending packages that keep them in power. And the government bails out the banks when they get into trouble. You scratch my back, I scratch yours. All along the way, of course, they both use other people’s money. YOUR money. Governments bail out the banks with taxpayer funds. Banks fund the government with their depositors’ hard-earned savings. Of course, it’s so absurd now that they’ve simply resorted to creating money out of thin air to benefit the both of them… which is precisely what central banks do. A decade ago during the 2008 global financial crisis, central banks around the world created trillions of dollars, euros, yen, etc. worth of currency and effectively gave it all away to their respective governments and commercial banks. In the Land of the Free, the US Federal Reserve conjured $4 trillion out of nothing and “loaned” most of it to the federal government at record low interest rates. But here’s the weird part: if you remember that inviolable law of bond prices– when interest rates go up, bond prices fall. And that’s exactly what’s been happening. The Fed bought trillions of dollars worth of government bonds at a time when interest rates were at historic lows. Then, starting about two years ago, the Fed began slowly raising interest rates. But each time the Fed raised rates, the value of the government bonds that they had purchased would fall. This seems insane, right? By raising rates, the Fed was creating massive losses for itself. I’ve written frequently that, as the Fed continues raising interest rates, it will eventually engineer its insolvency. Well, that’s now happened. Yesterday the Fed released its latest quarterly financial statements, showing that the value of their bonds is now $66.5 billion LESS than what they paid. And that $66.5 billion unrealized loss is far greater than Fed’s razor-thin $39 billion in capital. This means that, on a mark-to-market basis, the largest and most systemically important financial institution in the world is objectively insolvent. (It’s also noteworthy that the Fed’s financial statements show a NET LOSS of $2.4 billion for the first nine months of 2018.) This is all truly remarkable… and highlights how utterly absurd the financial system is. Our society has awarded an unelected committee the ability to conjure trillions of dollars out of thin air and render itself insolvent to support the ongoing, mutual back-scratching of governments and banks, all at your expense. But what’s even more remarkable, though, is how little anyone has noticed. You’d think the front page on every financial newspaper would be “FED INSOLVENT.” But it’s not. No one seems to notice that the Fed is insolvent. Or, for that matter, that most Western governments are insolvent. It’s crazy. It’s as if it doesn’t matter that the government of the largest economy in the world loses a trillion dollars a year, has $22 trillion in debt, $30+ trillion in unfunded pension liabilities, or suffers a debt-to-GDP ratio in excess of 100%. Or that the central bank of the largest economy in the world is insolvent on a mark-to-market basis according to its own financial statements. There seems to be an expectation that none of this matters and it will continue to be rainbows and buttercups forever and ever until the end of time despite some of the most compelling evidence to the contrary. It’s difficult to imagine a consequence-free future with data like this. Peaks, corrections, crises, etc. are often preceded by similar dismissive, willful ignorance and irrational optimism. It would be foolish to presume that this time is any different. About the Author Simon Black is an international investor, entrepreneur, and founder of Sovereign Man. His free daily e-letter Notes from the Field is about using the experiences from his life and travels to help you achieve more freedom, make more money, keep more of it, and protect it all from bankrupt governments. __________________________

Some thoughts on the ‘longest bull market ever’ Simon Black

August 23, 2018 Sovereign Valley Farm, Chile Well, it happened. Yesterday the US stock market broke the all-time record for the longest bull market ever. This means that the US stock market has been generally rising for nearly a decade straight… or even more specifically, that the market has gone 3,453 days without a 20% correction. That’s a pretty big milestone. And there’s no end in sight. So it’s possible this market continues marching higher for the foreseeable future. But if you step back and really look at the big picture, there are a lot of things that might make a rational person scratch his/her head. Did you know? You can receive all our actionable articles straight to your email inbox... Click here to signup for our Notes from the Field newsletter. For example– the Russell 2000 index (which is comprised of smaller companies whose shares are listed on various US stock exchanges) is currently right at its all-time high. Yet simultanously, according to the Wall Street Journal, a full SIXTY PERCENT of corporate debt issued by companies in the Russell 2000 is rated as JUNK. How is that even possible– a junk debt rating coupled with an all-time high? It’s as if investors are saying, “Well, there’s very little chance these companies will be able to pay their debts… but screw it, I’ll pay a record high price to buy the stock anyhow.” It just doesn’t make any sense. Looking at the larger companies in the Land of the Free (which make up the S&P 500 index), the current ‘CAPE ratio’ is now the second highest on record. ‘CAPE’ stands for ‘cyclically-adjusted price/earnings ratio’. Essentially it refers to how much investors are willing to pay for shares of a company, relative to the company’s long-term average earnings. And right now investors are willing to pay 33x long-term average earnings for the typical company in the S&P 500. The median CAPE ratio based on data that goes back to the 1800s is about 15.6. So at 33, investors are literally paying more than TWICE as much for every dollar of a company’s long-term average earnings than they have throughout all of US market history. And it’s only been higher ONE other time– just before the 2000 stock market crash (when the dot-com bubble burst). 33 is higher than right before the 2008 crisis. It’s even higher than it was before the Great Depression. In addition to the CAPE ratio, the average company’s Price-to-Book ratio is also the highest since the 2000 crash. In other words, investors are not only paying a near record amount for every dollar of a company’s long-term average earnings, but they’re also paying a near record amount for every dollar of a company’s net assets. The list of these record / near-record ratios goes on and on. Investors are also paying, for example, an all-time record Price-to-Revenue ratio… meaning that investors have never paid a higher price for every dollar of a company’s revenue… EVER. The general narrative is that everything is awesome in the US economy and will apparently remain that way forever and ever until the end of time. I certainly agree that there’s a lot of surface-level strength in the US economy right now. But I really wonder about the long-term. Just look at the average US consumer: despite the ultra-low unemployment rate in the US, average wages have barely budged. Pew Research released a great article earlier this month showing that, for most US workers, their wages have been stagnant for DECADES after you adjust for inflation. Plus we’ve all seen the statistics about how little the average American has stashed away in savings. Federal Reserve data from the Survey of Consumer Finances shows the median bank account balance is just $2,900. And for those under 35 it’s just $1,200. Overall the average US consumer has stagnant wages, little savings, almost nothing put away for retirement, record high credit card debt, record high student debt… and now rising inflation. So I’m just curious where all these companies are going to get their long-term revenue growth. Who is going to be buying all their products? Because the US consumer seems pretty tapped. (And if things are that bad in the boom times, just imagine what’s going to happen to US consumer behavior when recession hits again…) And aside from the US consumer, there are also a lot of companies that are going deeper into debt. I write about Netflix quite often, which has to take on billions of dollars of debt each year just to stay afloat. But even bigger companies have bizarre, head-scratching problems. Coca Cola is a great example– one of the oldest, most stable companies in the US market. Back in 2006 Coca Cola earned over $5 billion in profit. Last year Coca Cola earned $1.3 billion in profit. In 2006 Coca Cola had $1.3 billion in long-term debt. Last year Coca Cola had $31 billion in long-term debt. Yet Coca Cola’s stock price is near a record high, more than double its stock price in 2006. How does that make any sense? What’s more– Coca Cola’s ‘Free Cash Flow Yield’ is now 2.8%. This means that, after all expenses, accounting adjustments, and investments, the business generates enough money to pay investors a cash dividend worth 2.8% of the current share price. Yet Coca Cola’s -actual- dividend yield is 3.4%. How is it possible that that Coca Cola consistently pays its investors more money than the business generates? Easy. They just go into debt. General Motors is another great example: GM pays its investors a dividend yield of 4.1%. And that’s super attractive. Yet GM’s Free Cash Flow is actually NEGATIVE. There’s so much of this nonsense going on right now– companies going deeper into debt to pay dividends and support their share prices despite lackluster business performance. But again, despite the rising debt (and the rising level of JUNK debt), investors are still willing to pay record high multiples for their investments. This just doesn’t strike me as a great way to generate wealth and prosperity. __________________________ Catherine Austin Fitts – Enormous Level of Ignorance & Lawlessness in America

Greg Hunter Published on Apr 21, 2018 SUBSCRIBE 144K Investment advisor and former Assistant Secretary of Housing Catherine Austin Fitts says she sees an “enormous level of ignorance about how money works.” So, what can the average guy do to protect himself and his family? Fitts says, “You want to get as resilient as possible. You cannot solve a political problem with a financial solution. When we are talking about the level of lawlessness that we are seeing around the country now, it gets very granular on how you protect yourself. So, you want to get as resilient as possible, and you want to get as low of an overhead as possible and as low of debt as possible. If your income depends on the U.S. government, you want to make sure you have alternatives.” Join Greg Hunter as he goes One-on-One with financial expert Catherine Austin Fitts of Solari.com, home of “The Solari Report.” Donations: https://usawatchdog.com/donations/ _________________________

Interest Expenditures Will Now Exceed Military Spending – We are being Walled-In by our Own Debt

Blog/Sovereign Debt Crisis POSTED APR 16, 2018 BY MARTIN ARMSTRONG I have been warning for years at the World Economic Conferences that interest expenditures will reach the point that they will crowd out everything else. Well at last, as we enter 2019 and the War Cycle heats up, interest expenditures will now EXCEED even military spending. Welcome to the SOVEREIGN DEBT CRISIS. I have also stated for years that we elect people to run a government with absolutely NO QUALIFICATION whatsoever. There were people who want Oprah to run for President because she is (1) black and (2) a woman. This is the standard of expertise far too many people apply when it comes to politics. I have also made the analogy that this is like asking a cab driver to conduct open-heart-surgery on you because he smiles nice and holds a good conversation. Historically, society has always gone through a major debt crisis. Perhaps that is why the Bible talked about a debt jubilee where debt is simply forgiven even 49/50 years. One question that jumps out at us is rather blunt. Does the Old Testament Debt Jubilee present a solution to our modern financial crisis? The mere fact that this is in the Bible suggests that there must have been major debt crisis even before the Bible. We do know that Hammurabi’s Law Code imposed regulation on interest. It also imposed Contract Law and required people to reduce agreements to writing that were witnessed. By implication, such a law must have meant that one person said he lent money and the other denied it. We have legal records that have survived from Babylon which even demonstrate they had an active futures market where people bought a crop for future delivery creating even options. One of the earliest Debt Crisis in recorded history that is well documented by contemporary writers was the Debt Crisis in Athens of 354BC. Corruption between government and the bankers is nothing new. The banks were the Temples since money was donated to the gods who had no use for it. Typically, the government would borrow from this hoard of Temple money to fund wars. The priests became the bankers. In Athens during 354BC, there was one of the early banking crisis events involving what we would call the Secretary of the Treasury so to speak and his banking friends. The money grew to a vast sum in the Temple which kept all these donations in the Opisthodomos. The Temple was not earning interest on its hoard of money which just sat there funding the lavish lifestyle of the priests. The treasurer agreed to lend the money to personal banking friends who would then pay the treasurer interest that he could then personally put that in his pocket. When the banking crisis hit and there was a liquidity problem, the banks could not repay the loans to the Temple. Most of the loans were going to real estate. When the business cycle hit and real estate turned down, people could not pay their debts and could not sell the property in a down market. Suddenly, the bankers could not repay the priests so they then tried to cover up their scheme by setting fire to the Opisthodomos. Nevertheless, the scheme was detected and the Treasurers of the Temple of Athena were seized and imprisoned, about 377-376BC. In 1989, government ministers of Crete pulled the same scam. They were depositing government funds in the Bank of Crete and interest was being diverted to themselves. It was the failure of the Bank of Crete that exposed the scam (See NY Times, 9/21/89, A14; 9/27/89, A3). So you see, history repeats like a Shakespeare play – just the actors change over the centuries while the storyline remains unchanged. Obviously, debt and contracts have been around for thousands of years. Is there a dramatic and simple way out of all this? Some argue that there is a “debt jubilee” they take from the Old Testament book of Deuteronomy, the concept derives from the biblical injunction for a day of rest one day out of every week, a “sabbath” day. There appears to be a fractal system which is laid out in the Bible. The next injunction is for a Sabbath year every 7th year. Here, people are to not work. The next injunction appears on the year after the 7th of those sabbatical years, i.e. the 50th, (one year after the 49th). This is where we find there would be a jubilee year during which any slaves would be emancipated and everyone would return to their land and family to live off of natural providence. A clear implication of this teaching is that all obligations, including debt obligations, would be forgiven in the process. I do find it curious that this lines up fairly closely with the Economic Confidence Model (ECM) and its 6 waves of 8.6-year intervals which build up to major events every 51.6 years. Is the Bible saying that there is a debt crisis every 50 years where the solution is to default on all debts? The next 51.6-year target on the ECM will come in 2032 and our model does show that the West will yield the crown of the Financial Capital of the World to China. So does the Biblical Debt Jubilee suggest we “should” forgive all debts at the 50th interval of the 7th year or does it forecast that debts will be forgiven simply because everything will crash at that point? I have further warned that our elected officials could not even run a bubblegum machine as a business. When they spend all the money they took in on themselves, they have nothing left to buy more gum to refills the machine. Their solution is just to raise taxes and refill the machine and spend it all again on themselves with lavish perks and pensions. The Sovereign Debt Crisis is alive and well. This is now when it is going to begin to surface to where it will become more obvious to people around the world. Indeed, I am off to Europe today for this very reason with two weeks of meetings. The risk is beginning to become obvious as interest expenditures will crowd out everything other areas of spending. Governments will try to keep the debt revolving by raising taxes and this will only further reduce both the economy and our living standards. We are being walled-in by our own debt with no place to go except default if we do not act NOW!!!!!!! ________________________ |

What a bunch of idiots

Simon Black October 25, 2018 Santiago, ChileTell me this isn’t crazy– A few days ago the creator of the most famous consumer ‘credit score’ in the United States announced a major overhaul in how it rates borrowers. Consumers live and die by this ‘FICO score’. A high FICO score means that it’s easy to obtain loans at lower interest rates. And a bad FICO score (in theory) means that you have a history of not paying your debts… hence making it difficult to obtain loans. Did you know? You can receive all our actionable articles straight to your email inbox... Click here to signup for our Notes from the Field newsletter. Well it turns out there are tens of millions of people in the US who either don’t have FICO scores at all (i.e. NO credit history), or they have BAD credit. So FICO decided that they would reinvent the way they calculate the scores– giving a big boost to people with bad credit. Virtually overnight, people who have a history of not paying their bills will immediately be deemed creditworthy. And poof… they’ll have access to more debt than ever before. No offense, but what a bunch of idiots. This company is deliberately lowering its standards and pretending that people with a terrible credit history are actually top quality borrowers. Gee where have we seen this before? Oh that’s right… just before the massive financial crisis ten years ago! It’s genius! It wasn’t even that long ago during the housing boom in the early 2000s that banks were doing EXACTLY the same thing– deliberately lowering their lending standards and providing loans (WITH NO MONEY DOWN) to borrowers with bad credit. Everyone was in on it. The big ratings agencies like S&P and Moody’s all played along. Even the federal government gave its seal of approval to this ridiculous charade. But eventually the bubble burst. Interest rates started rising and the borrowers could no longer pay. Housing prices tanked. Banks lost billions. The stock market plummetted. The economy went into a tailspin. It unraveled so quickly… and it all started with a system that churned out far too much debt, far too easily, to borrowers who had no hope of paying it back. And that’s precisely what we’re seeing now. It starts at the top: the US government is sitting on a record $21.7 trillion in debt. That’s several trillion dollars more than the size of the entire US economy. Each year the government burns around a trillion dollars, and the Treasury Department expects to sustain those grim deficits for the foreseeable future. State and local governments are in a similar position– in debt up to their eyeballs and drowning in unfunded pension obligations. And each year it gets worse. The government’s own projections show the debt only increasing– they have no chance of paying it off. Even in the private sector, most corporations aren’t much better off. Not including banks, companies in the US have around $7 trillion in total debt. Go figure, that’s the highest amount on record. Ever. More than 40% of all corporate debt is rated just one notch above ‘junk’ status. And a full 14% of companies in the S&P 500 don’t even generate enough revenue to make interest payments. Then there’s the consumer– supposedly the rock solid pillar that drives the US economy. Consumer debt is on pace to reach a record $4 trillion this year. Credit card debt is at an all-time high. Auto loans are at an all time high. Student debt is at an all time high. And the average American has little chance of repaying that debt. According to a recent study published by the Federal Reserve, 40% of adults don’t have enough money to cover a $400 emergency expense like a medical bill or flat tire. And 21% of Americans have ZERO savings. Neither governments, nor most businesses, nor the consumer, has any chance of paying down these debts. And yet the money keeps flowing. Companies like FICO are even lowering their standards to give even MORE debt to consumers who are already too heavily indebted. And investors across global financial markets clamor to buy bonds of companies and governments that routinely burn through billions of dollars in cash. It’s pretty extraordinary how history repeats itself. The financial system creates gigantic problems caused by too much debt… then tries to solve that problem with more debt. The house of cards eventually collapses… people lick their wounds for a few years… and the whole cycle begins anew. If you’re looking for a great book on the topic, check out Howard Marks’ Mastering the Market Cycle: Getting the Odds on Your Side. Marks is the billionaire founder of Oaktree Capital and one of the most successful investors in history. In short, his book describes what we have been discussing for months– There are always ups and downs, booms and busts. NOTHING moves in a straight line forever. The economy (and financial markets) have been moving UP in a straight line for most of the last ten years. And by any historical perspective, this is one of the LONGEST up cycles on record. We’re seeing the same foolish shenanigans that we almost always see– too much money, too much debt, too much stupidity. Could it last for several more months, or even years? Absolutely. Or perhaps it’s possible that the tide has already started to turn. We won’t know until some point in the future when we look back and say, ‘Oh yeah, that was the top. Duh. Shoulda seen that coming… All the signs were there.’ Just remember last time– the US stock market peaked in October 2007. The big meltdown didn’t take place until almost a year later. And all along the way– the pundits, the government, the Federal Reserve– everyone kept saying that the economy was strong and healthy… right up until the worst financial crisis since the Great Depression hit. We’re seeing so many of the same signs that we saw ten years ago. It would be foolish to think that it will be rainbows and buttercups forever… that this time will be any different. And to continue learning how to ensure you thrive no matter what happens next in the world, I encourage you to download our free Perfect Plan B Guide. Because... If you live, work, bank, invest, own a business, and hold your assets all in just one country, you are putting all of your eggs in one basket. You’re making a high-stakes bet that everything is going to be ok in that one country — forever. All it would take is for the economy to tank, a natural disaster to hit, or the political system to go into turmoil and you could lose everything—your money, your assets, and possibly even your freedom. ___________________________ Robots fight weeds in challenge to agrochemical giants

MAY 22, 2018 Ludwig Burger, Tom Polansek YVERDON-LES-BAINS, Switzerland/CHICAGO (Reuters) - In a field of sugar beet in Switzerland, a solar-powered robot that looks like a table on wheels scans the rows of crops with its camera, identifies weeds and zaps them with jets of blue liquid from its mechanical tentacles. Undergoing final tests before the liquid is replaced with weedkiller, the Swiss robot is one of new breed of AI weeders that investors say could disrupt the $100 billion pesticides and seeds industry by reducing the need for universal herbicides and the genetically modified (GM) crops that tolerate them. Dominated by companies such as Bayer, DowDuPont, BASF and Syngenta, the industry is bracing for the impact of digital agricultural technology and some firms are already adapting their business models. The stakes are high. Herbicide sales are worth $26 billion a year and account for 46 percent of pesticides revenue overall while 90 percent of GM seeds have some herbicide tolerance built in, according to market researcher Phillips McDougall. “Some of the profit pools that are now in the hands of the big agrochemical companies will shift, partly to the farmer and partly to the equipment manufacturers,” said Cedric Lecamp, who runs the $1 billion Pictet-Nutrition fund that invests in companies along the food supply chain. In response, producers such as Germany’s Bayer have sought partners for their own precision spraying systems while ChemChina’s Syngenta [CNNCC.UL], for example, is looking to develop crop protection products suited to the new equipment. While still in its infancy, the plant-by-plant approach heralds a marked shift from standard methods of crop production. Now, non-selective weedkillers such as Monsanto’s Roundup are sprayed on vast tracts of land planted with tolerant GM seeds, driving one of the most lucrative business models in the industry. ‘SEE AND SPRAY’ But ecoRobotix www.ecorobotix.com/en, developer of the Swiss weeder, believes its design could reduce the amount of herbicide farmers use by 20 times. The company said it is close to signing a financing round with investors and is due to go on the market by early 2019. Blue River, a Silicon Valley startup bought by U.S. tractor company Deere & Co. for $305 million last year, has also developed a machine using on-board cameras to distinguish weeds from crops and only squirt herbicides where necessary. Its “See and Spray” weed control machine, which has been tested in U.S. cotton fields, is towed by a tractor and the developers estimate it could cut herbicide use by 90 percent once crops have started growing. German engineering company Robert Bosch here is also working on similar precision spraying kits as are other startups such as Denmark's Agrointelli here ROBO Global www.roboglobal.com/about-us, an advisory firm that runs a robotics and automation investment index tracked by funds worth a combined $4 billion, believes plant-by-plant precision spraying will only gain in importance. “A lot of the technology is already available. It’s just a question of packaging it together at the right cost for the farmers,” said Richard Lightbound, Robo’s CEO for Europe, the Middle East and Africa. “If you can reduce herbicides by the factor of 10 it becomes very compelling for the farmer in terms of productivity. It’s also eco friendly and that’s clearly going to be very popular, if not compulsory, at some stage,” he said. ‘PAUSE FOR THOUGHT’ While Blue River, based in Sunnyvale, California, is testing a product in cotton fields, it plans to branch into other major crops such as soy. It expects to make the product widely available to farmers in about four to five years, helped by Deere’s vast network of equipment dealers. ROBO’s Lightbound and Pictet’s Lecamp said they were excited by the project and Jeneiv Shah, deputy manager of the 152 million pound ($212 million) Sarasin Food & Agriculture Opportunities fund, said the technology would put Bayer and Syngenta’s crop businesses at risk while seed firms could be hit - albeit to a lesser extent. “The fact that a tractor and row-crop oriented company such as John Deere did this means it won’t be long before corn or soybean farmers in the U.S. Midwest will start using precision spraying,” Shah said. While the technology promises to save money, it could be a tough sell to some U.S. farmers as five years of bumper harvests have depressed prices for staples including corn and soybeans. U.S. farm incomes have dropped by more than half since 2013, reducing spending on equipment, seeds and fertilizer. Still, the developments are giving investors in agrochemicals stocks pause for thought, according to Berenberg analyst Nick Anderson. And agrochemical giants are taking note. Bayer, which will become the world’s biggest seeds and pesticides producer when its acquisition of GM crop pioneer Monsanto completes, teamed up with Bosch in September for a “smart spraying” research project. The German partners plan to outpace rivals by using an on-board arsenal of up to six different herbicides and Bayer hopes the venture will prepare it for a new commercial model - rather than cannibalizing its current business. “I would assume that within three years we would have a robust commercially feasible model,” Liam Condon, the head of Bayer’s crop science division said in February. “I’m not concerned in terms of damping sales because we don’t define ourselves as a volume seller. We rather offer a prescription for a weed-free field, and we get paid based on the quality of the outcome,” he said. Bayer agreed to sell its digital farming ventures, including the Bosch project, to German rival BASF as part of efforts to win antitrust approval to buy Monsanto. But BASF will grant Bayer an unspecified license to the digital assets and products. BASF said the Bosch precision spraying collaboration was very interesting but it was too early to comment further as the transaction had not completed. ‘PART OF THE STORY’ Syngenta, which was an investor in Blue River before Deere took over, said the advantages of the new technology outweighed any potential threats to its business model. “We will be part of the story, by making formulations and new molecules that are developed specifically for this technology,” said Renaud Deval, global head of weed control at Syngenta, which was bought by ChemChina last year. While it has no plans to invest directly in engineering, Syngenta is looking into partnerships where it can contribute products and services, Deval said. Still, Sarasin’s Shah said the big agrochemical firms would need to accelerate spending on getting their businesses ready for new digital agricultural technology. “The established players need to invest a lot more than they currently are to be positioned better in 10 years’ time. The sense of urgency will increase as farmers start to adopt some of the more advanced kits that are coming out,” he said. The prototype of an autonomous weeding machine by Swiss start-up ecoRobotix is pictured during tests on a sugar beet field near Bavois, Switzerland May 18, 2018. REUTERS/Denis BalibouseMichael Underhill, chief investment officer at Capital Innovations, also said the major players may be underestimating the potential impact on their pesticides businesses. “Precision leads to efficiency, efficiency leads to decreased usage, decreased usage leads to decreased margins or margin compression, and that will lead to companies getting leaner and meaner,” said Underhill. He said the GM seeds market would also take a hit if machine learning takes over the role genetic engineering has played so far in shielding crops from herbicides’ friendly fire. “Instead of buying the Cadillac of seeds or the Tesla of seeds, they may be buying the Chevy version,” Underhill said. NEW WEAPONS The advent of precision weed killing also comes at a time blanket spraying of global blockbusters such as glyphosate is under fire from environmentalists and regulators alike. More than 20 years of near-ubiquitous use of glyphosate, the active substance in Monsanto’s Roundup, has created resistant strains of weeds that are spreading across the U.S. farm belt. Regulators have raised the bar for bringing blanket chemical agents to market and the fear of toxic risks has been heightened by the debate over the potential impact of glyphosate on health. Michael Owen, associate chair at Iowa State University’s Department of Agronomy, reckons it would now cost agrochemical giants up to an almost prohibitive $400 million to develop a next-generation universal weedkiller. Bayer’s Condon said in the current environment precision spraying could well be the final blow to further attempts to develop new broad-spectrum or non-selective herbicides. “Everything that comes tends to be selective in nature. There won’t be a new glyphosate. That was probably a once-in-a-lifetime product,” said Condon. For now, the industry is reviving and reformulating older, broad-spectrum agents known as dicamba and 2,4-D to finish off glyphosate-resistant weeds - and it is selling new GM crops tolerant to those herbicides too. Slideshow (16 Images)Precision spraying could mean established herbicides whose effect has worn off on some weeds could be used successfully in more potent, targeted doses, said Claude Juriens, head of business development at ecoRobotics in Yverdon-les Bains. But experts say new products will still be needed for the new technology and some chemical firms are considering reviving experimental herbicides once deemed too costly or complex. “Because we’re now giving the grower an order of magnitude reduction in the amount of herbicide they’re using, all of a sudden these more expensive, exotic herbicides are now in play again,” said Willy Pell, Blue River director of new technology. “They’ve actually devoted resources to looking through their backlog, kind of cutting room floor, and rethinking these different materials with our machine in mind,” he said. _________________________ Rob Kirby - Money Needed For Hyperinflation Already Printed

Greg Hunter Published on Mar 31, 2018 Forensic macroeconomic analyst Rob Kirby says “All the money needed for hyperinflation has already been printed.” Kirby contends, “It’s kind of like having a nuclear war, and people say where are the bombs going to come from? The bombs are going to come out of their silos. What people can’t believe or can’t wrap their head around is the notion and the fact that there’s $21 trillion or more that’s been ‘siloed.’ The money has been created and siloed. We know it’s been created because we know it flew through the books of the Department of Defense (DOD) and the Department of Housing and Urban Development (HUD). That’s just two government agencies. . . . We’re talking about tens of trillions of dollars. We don’t know exactly where they are or who controls them. . . . This is why you want to own some tangible stuff. This is why you want to own physical bullion, such as coins and bars, and you want to have them in your control.” Join Greg Hunter as he goes One-on-One with Rob Kirby of KirbyAnalytics.com. Donations: https://usawatchdog.com/donations/ Stay in Contact with USAWatchdog.com: https://usawatchdog.com/join/ |

The Economic Collapse: Are You Prepared For The Coming Economic Collapse And The Next Great Depression?