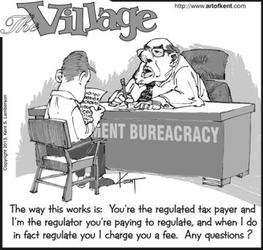

Thank You Kent Lamberson

Thank You Kent Lamberson

Your tax dollars at work: Govt officially forgiving student debt

Simon Black December 31, 2018 Dorado, Puerto RicoWhen all the tribes of Israel still lived in their holy land, they practiced something called the Jubilee. According to the Book of Leviticus, the Jubilee existed because the Israeli land actually belonged to their god Yahweh…. and the current owners were just borrowing it (sounds like land ownership today – try not paying your property taxes and see who really owns your land). So every 49 years, the Israelites would celebrate by freeing slaves, redistributing property and forgiving debts. Of course, a 49-year cycle where debt is forgiven and land is returned to previous owners is ridiculous… markets can’t function under this system. Imagine buying a piece of land and not knowing if you have to give it back down the road… or lending someone money with the possibility that those debts just disappear and you get nothing back for the risk you took. The Jubilee originated sometime around 1406 BC, so you would think it’s ancient history. Fast forward 3500 years… The US government is a record $21 trillion in debt and running $1 trillion annual deficits. US corporations have a record $9 trillion in debt – with nearly half of that debt maturing in the next five years (meaning the businesses either have to roll that debt into a new loan or pay it back). Consumer debt – which includes credit card debt, auto loans and student debt – is already at a record high and should pass $4 trillion in 2019. But the largest portion of consumer debt is student debt. Yes, Americans have borrowed $1.5 TRILLION to earn degrees of questionable use. As I wrote in a previous Notes: According to the latest stats, the average student loan debt in the US is nearly $40,000. But that’s just average… There are more than two million former students in the Land of the Free with more than $100,000 of debt… around 415,000 people have more than $200,000 of student debt. And the US Department of Education guarantees 90% of that debt. Which means you, the taxpayer, guarantee that debt. If the borrower defaults, YOU’RE on the hook. What are the chances millennials will make good on the debt? Not great… According to a recent Fed study, millennials are much poorer and indebted than previous generations. Even if they are financially able to repay student loans, you then have to question their will to do so when you can do so many other cool things with the money… Like this YouTube bro who made a video bragging about using his financial aid money to take his girlfriend on a trip to Thailand. Already we’re seeing student loan defaults creep up… Loans issued in 2012 are defaulting at a faster rate than ever before. Interest rates are only rising. Over 44 million Americans owe student loans, and according to the Federal Reserve, 11.2% of them are delinquent (at least 90 days late) or in default. It’s hard enough to pay back your loans if you study medicine to become a doctor, or something else that could lead to a relatively high paying career. But now 22-year olds are graduating with $200,000 of debt, and all they have to show for it is an undergraduate degree in underwater basket weaving. No direction. No plan. Just a useless degree. Then there’s the adults who are still swimming in student debt… There are even almost 2 million Americans over the age of 62 who still owe a combined $62 billion in student loans. That’s over 32 grand per borrower over 62. I don’t think Social Security is going to cover that… even if by some miracle it stays solvent. Given these headwinds, we’ve been wondering how on earth this crushing student debt load will ever be paid back. And I think we just got our answer. This month, Secretary of Education Betsy Davos agreed to forgive $150 million worth of student debt. It’s a mini Jubilee. Here’s the thing… Betsy Davos did NOT want to forgive this debt. She fought to change the rules, but an Obama era forgiveness policy was enforced by the courts. So if one of the meanest women in government can’t stop this debt from being forgiven… just imagine if we had someone like Bernie Sanders or Kamala Harris steering the ship. And who do you think is going to come after Trump? Trump was America’s response to Obama. And the next pendulum swing will be even greater to the left. So we just saw the first $150 million… and there’s another $1.465 trillion to go in the debt jubilee. If you ever wondered why I think it’s a moral obligation to pay as little taxes as possible, this is it. If you want to give the government your dollars to fund YouTube bro to go to Thailand, go ahead. I’ll be in Puerto Rico, paying a 4% corporate tax rate and 0% capital gains. Maybe I’ll see you down here. ___________________________

House passes massive tax package; Senate to vote next

By STEPHEN OHLEMACHER and MARCY GORDON Published December 19, 2017 Markets Associated Press NextWASHINGTON – Gleeful Republicans on Tuesday muscled the most sweeping rewrite of the nation's tax laws in more than three decades through the House. House Speaker Paul Ryan dismissed criticism of the widely unpopular package and insisted "results are what's going to make this popular." The vote, largely along party lines, was 227-203 and capped a GOP sprint to deliver a major legislative accomplishment to President Donald Trump after a year of congressional stumbles and non-starters. Senate Majority Leader Mitch McConnell, R-Ky., said the Senate would vote Tuesday evening, sending the legislation to Trump for his signature. The massive $1.5 trillion package would touch every American taxpayer and every corner of the U.S. economy, providing steep tax cuts for businesses and the wealthy, and more modest tax cuts for middle- and low-income families. It would push the national debt ever higher. The standard deduction used by most families would be nearly doubled, to $24,000 for a married couple, while those who itemize would lose some deductions. "We're delivering a tax code that provides more jobs, fairer taxes and bigger paychecks to Americans across the country," said Rep. Kevin Brady of Texas, Republican chairman of the tax-writing Ways and Means Committee. "Our local job creators will see the lowest rates in modern history so they can invest more in their workers and in their future." Democrats called the bill a giveaway to corporations and the wealthy, providing little if any tax help to the less-than-well-to-do and no likelihood that business owners will use their gains to hire more workers or raise wages. And the Republicans' contention that the bill will make taxes so simple that millions can file "on a postcard" — an idea repeated often by the president — was simply mocked. "What happened to the postcard? We're going to have to carry around a billboard for tax simplification," declared Rep. Richard Neal of Massachusetts, the top Democrat on the Ways and Means Committee. Tax cuts for corporations would be permanent while the cuts for individuals would expire in 2026 in order to comply with Senate budget rules. The tax cuts would take effect in January. Workers would start to see changes in the amount of taxes withheld from their paychecks in February. During debate, decorum on the House floor was fleeting as two New Yorkers — a Democrat and a Republican — voiced their opinions on the bill. Rep. Joe Crowley, D-N.Y., yelled, "Hell no" in opposition to the bill. Rep. Tom Reed, R-N.Y., replied, "Hell yes!" The proceedings were interrupted several times by protesters shouting from the gallery. The bill is unpopular among the public, and Democrats plan to campaign against it in next year's congressional elections. Senate Democrats posted poll numbers on the bill on a video screen at their Tuesday luncheon. "This bill will come back to haunt them, as Frankenstein did," said House Democratic leader Nancy Pelosi. Not so, said Ryan, who has worked for years on tax overhaul. "When we get this done, when people see their withholding improving, when they see jobs occurring, when they see bigger paychecks, a fairer tax system, a simpler tax code, that's what's going to produce the results," said Ryan, R-Wis. The bill would slash the corporate income tax rate from 35 percent to 21 percent. The top tax rate for individuals would be lowered from 39.6 percent to 37 percent. It scales back a popular deduction for state and local taxes, repeals a key tenet of Barack Obama's Affordable Care Act and allows drilling in the Arctic National Wildlife Refuge. Despite GOP talk of spending discipline, it is projected to add $1.46 trillion to the nation's debt over a decade. GOP lawmakers say they expect a future Congress to continue the tax cuts so they won't expire. If achieved, that would drive up deficits even further. Republicans acknowledged they still have to convince many Americans of the benefits of their bill. Many voters in surveys see the legislation as a boost to the wealthy, such as Trump and his family, and only a minor gain for the middle class. "I don't think we've done a good job messaging," said Rep. Greg Walden, R-Ore. "I don't think we've gotten out there with specifics, and the final bill has only come together in the last week or so. Now, you're able to look at the final product." The $1,000-per-child tax credit doubles to $2,000, with up to $1,400 available in IRS refunds for families who owe little or no taxes. Parents would have to provide children's Social Security numbers to receive the child credit, a measure intended to deny the credit to people who are in the U.S. illegally. The legislation also repeals an important part of the health care law — the requirement that all Americans carry health insurance or face a penalty — as the GOP looks to unravel a law it failed to repeal and replace this past summer. The bill would initially provide tax cuts for Americans of all incomes. But if the tax cuts for individuals expire, most Americans — those making less than $75,000 — would see tax increases in 2027, according to congressional estimates. Disgruntled Republican lawmakers from high-tax New York, New Jersey and California receded into the background as the tax train rolled. They oppose the new $10,000 cap on the deduction that millions use in connection with state and local income, property and sales taxes. The cap remains in the final bill. The deduction is especially vital to residents of high-tax states. Several defectors reaffirmed their "No" votes for the final bill on Tuesday. Rep. Peter King conveyed what people in his Long Island, New York, district were telling him about the tax bill: "Nothing good, especially from Republicans. ... It's certainly unpopular in my district," he said. ___ Associated Press writers Kevin Freking and Alan Fram contributed to this report. ____________________________

Senate Passes Motion To Proceed On Tax Reform

JULIEGRACE BRUFKE Capitol Hill Reporter 6:16 PM 11/29/2017 The Senate passed the motion to proceed on the GOP’s tax reform legislation Wednesday along party lines, allowing the upper chamber to bring the bill to the floor as soon as Thursday. Senators can now officially start debate on the reconciliation measure, which allows Republicans to pass the bill with just a simple majority. The bill includes steep tax cuts for both the individual and corporate rates and repeals the Obamacare individual mandate. While Senate Republicans unanimously voted to advance the measure, its final passage is not guaranteed. A number of lawmakers — including Sens. John McCain of Arizona, Jeff Flake of Arizona, Susan Collins of Maine, Ron Johnson of Wisconsin, Steve Daines of Montana and Bob Corker of Tennessee — have cited concerns about the bill ranging from its potential to increase the deficit to problems with its language on pass-throughs. While hesitations remain, the measure is open to unlimited amendments, several of which are expected to be adopted. The lower chamber passed its measure in a 227 to 205 vote earlier this month. House Majority Leader Kevin McCarthy said he advised members to keep their schedules flexible as the House is hopeful the Senate will pass its bill which is expected to be conferenced between the two chambers. Follow Juliegrace Brufke on Twitter ____________________________ _______________________Officious

Thank you Kent Lamberson __________________________ |

|